Index funds as the death of human agency. The S&P 500 as the Human Instrumentality Project. Through the Index, the past eats the future.

When I was a young kid, my father sat me down and taught me about investing. My first lesson was on the S&P 500 Index (Peace Be Upon It.) We got on the desktop computer and he pulled up this website with a compound interest calculator and he told me look, if you just put $1000 into the Index every month, it compounds at 8% annually and you’ll be a millionaire in 25 years! Isn’t that amazing?

At that age, my first thought was that 25 years sounds like a long time. 15 years later, It still does, but less so. My second thought was that this smells fishy, even to a dumb little kid. 15 years later, it still does. Maybe even more so than before.

Now I’m not in the business of denying reality. I see with my eyes and understand intellectually that the Fortune 500 companies, and particularly the elohim known as the MAG7, are the most investable financial vehicles in human history. We take these fantastic companies and compile them together to create the Index. Then on top of that we kick out and replace underperformers on a regular basis. I understand the argument for indexing. But I still can’t shake the feeling something is terribly wrong. Let me try to elucidate my thoughts.

First, the Bull Case:

Being a shareholder of a US megacorporation is the best position in the world. The best and brightest minds from across the globe are at your service. They organize together and work tirelessly day and night all aligned towards a singular goal: to bring you profit.

No coercion involved. They beg you to let them work for you. Tripping over themselves hand and feet to do it. They put themselves through rigorous education, standardized tests, grueling interviews, just for a chance at service. The Pharaohs built the pyramids through slave labor. We build greater monuments every day through “At-Will Employment.”

There is no more war, no more famine, no more pestilence. The horsemen of the Apocalypse stood in the way of sacred fiduciary duty, so we eliminated them. Soon we will have slain Death as well. The system is perfect, self-correcting, beyond possibility of intelligent design.

And through the instrument known as the Index, you can buy exposure to this system for the low price of a 0.09% fee. You can just park your money and then sit back and let the sum total of human talent work for you. No effort or thinking required. Why wouldn’t you do this? Are you stupid?

The Bear Case (Logical):

On the other hand, there are a few reasonably convincing logical arguments against indexing. First, past performance is not indicative of future returns. Some would argue that S&P performance over the past 40 years is not purely caused by the excellence of the companies, but rather by American excellence in general. What happens in the next 40 years? Refer to the Nikkei 225 from 1989-2024 for one possible outcome.

Second, the private vs public market issue. Google IPO’d in 2004 at a 23B valuation. That’s a calm 150x today. Facebook IPO’d in 2012 at 104B— 15x. Let’s not even discuss the Microsoft or Apple IPO valuations. Meanwhile today we have OpenAI valued at 500B pre-IPO. SpaceX, already at 800B in private markets, is targeting 1.5T for its IPO. The growth has already been captured in private rounds. By the time they make it into the Index, how much juice is left for public investors?

That’s really the best I could come up with as far as logical arguments. These are valid points, but in no way do they outweigh the overwhelming advantages of indexing. From a personal finance standpoint, you are still almost always better off parking your money in indexes. Focus on making more money instead.

I am more concerned about the effect of passive investing on our society at a spiritual level. From here on this essay may go a bit off the rails. Continue at your own risk.

The Bear Case (Spiritual):

I used to think that Consumer Sovereignty was important. If we don’t like a product, we can choose to buy one of their competitors instead. In this way the capital markets serve the consumer. I thought this was the way capitalism was supposed to work. Maybe this was naive.

Under the passive investing gospel there is no more choice. There’s not even the illusion of choice. Your 401K money goes directly to the MAG7 elohim and they use that capital to buy up any and all possible competitors. Like a black hole sucking in all matter in its vicinity. Where are the competitors to Google? Amazon? Instagram? They don’t exist. They cannot exist, under the physical law of Capital Gravity.

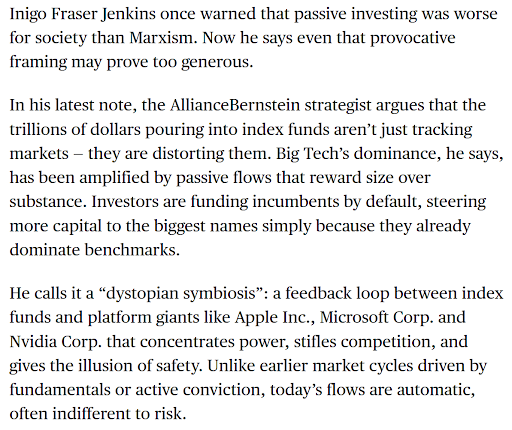

Market distortions caused by trillions of dollars of passive index flows. Capital gravitating towards itself in an accelerating feedback loop. Baudrillard wrote about this in the 1970s. I am not knowledgeable enough about market dynamics to extrapolate the end result of all this. Maybe the world capital market collapsing in on itself like a black hole is actually a good thing. I don’t know. I just get the sense that we’ve already passed the event horizon— the obsolescence of human judgement.

Implosion:

Passive indexing represents the death of human agency. The S&P500 as the Human Instrumentality Project. Your individual choice is no longer meaningful. Your flesh is inferior to the perfection of the machine. Just put your money in the Index and become one with the System.

The Index is Baudrillardian implosion. By design it rewards what has already won, at the expense of what might win next. The indexed economy is endlessly self-referential, folding back in on itself in an endless feedback loop. The money mechanically flows to the biggest companies, making them bigger, thus attracting more flows. Any real innovation or competition is systematically snuffed out, or acquired and folded into the simulacrum. Capital allocation grows increasingly divorced from human discretion. Through the Index, the past eats the future.

This is the death of taste, the end of human choice. You can see it in our cultural output. Everything we produce is exactly the same, hyperoptimized towards the lowest common denominator. Marvel movies, Chipotle and Cava bowlslop, new apartment developments. All production converges on a singularity of mediocrity. Discretion is dead, cold efficiency be our god.

What Next?

Let’s take a step back. Maybe I’m being too harsh. I don’t actually believe the S&P 500 index is the root of all evil. Although it certainly plays its part. I think the rise of passive investing, the homogenization of culture, the decline of human choice, these are symptoms of a greater problem.

The end of the Age of Exploration. For as long as humans have existed, there has always been a frontier. Beyond which lies the unknown, which has filled our imaginations and haunted our dreams for eons. But now there is nothing. We have conquered all of Earth, and now we are as children who have grown bored of our little sandbox. In Genesis God told us to be fruitful and multiply; fill the earth and subdue it. Now that it is done, what comes next?

When there's no frontier, Capital has nowhere to go but inward. We turn our attention to our economy and we ruthlessly analyze, optimize, extract. In the name of efficiency. Squeeze every last drop of excess value out of whatever we can financialize. Like drilling for oil. First we take the easy pickings that flow onto the surface out of the sand. Once that’s gone we drill deeper. Finally we must drill under the ocean, into rock, extract oil from shale. Implosion.

The Index is the mechanism of that implosion. Its dominance tells me we are in the late stages now. All obvious inefficiency is gone, there is not much juice left to extract. There is no inspiration left in our collective consciousness, we have forgotten how to dream. The best we can do is throw our money in the Index and pray to it for deliverance.

I don’t know what comes next. Maybe we find a new frontier to explore, like space, which reawakens the human spirit of exploration and ushers in a new Renaissance. Or maybe we don’t, and the system completely implodes in on itself, and then we build something better out of the ashes. I don’t know.

All I know is that personally I will fight till the bitter end. I will live by the sword and die by it too. I will not park (all) my money in an index. I will continue to punt shitcoins and buy stocks of companies that I believe in. And if in this way death (underperformance) comes for me then so be it.